The impending loss of a loved one can be difficult for anyone to deal with, struggling through raw emotion while also trying to figure out how to deal with the expenses that may come with the passing of a family member or friend.

Whole life insurance can provide the safety net needed to handle a litany of expenses, there are other options to consider like life settlements or viatical settlements. However, anything during this time, no matter how expedited needs to be handled with the utmost care.

Table of Contents

Viatical Settlements

You may have seen some reference to a viatical settlement contract through advertisers or mentioned online, but what is a viatical settlement? It is when a patient dealing with a terminal illness option off their life insurance policy for a lump-sum payout acquired through the use of a viatical settlement broker. That broker will offer up the insurance policy to viatical settlement providers who will purchase it for less than the policy’s face value, or death benefit, but more than the cash surrender value.

In dealing with a terminal or chronic illness, a policyholder may want to seek the cash value from a viatical settlement to help pay off outstanding medical debts or explore different treatment options that are available. They may also use the payout to cover any other outstanding debts to not leave their family with any burden financially upon their passing. This differs from a life insurance settlement that can be realized by no longer wanting to take care of the premium payments to insurers. Such settlements also don’t require a terminal condition for policyholders.

Handling a Difficult Time

Viatical settlement companies understand that in dealing with policyholders and settlement providers, there needs to be a level of sensitivity. After all, you are dealing with ill patients and family members preparing to lose the person they love to a terminal illness. Viatical settlement companies are accessible through a variety of communications, perhaps most directly by phone call.

Viatical brokers may set up an outbound call center to deal with the flow of viatical settlement transactions while providing the personal touch on behalf of a viator. An outbound contact center offers a choice of dialing modes based on particular requirements and has safeguards under Telephone Consumer Protection Act (TCPA) regulations. This allows brokers and settlement providers the ability to seamlessly communicate with clients from the initial phone call to the lump sum cash payout. This also ensures privacy through communication laws and regulations in the U.S.

Proper Response

These outbound centers are designed to assure that call center agents provide the care for each individual policy and settlement when dealing with families in a difficult situation. This also guarantees privacy for any medical information or personal information that should only be kept between the viator, broker, and the settlement firm. Oftentimes, viatical settlements can lead to an internal predicament for some families, making sure they are the better option in an extremely difficult situation.

While viaticals may be able to handle medical expenses in the now, it is important to have family members and loved ones consult before moving forward with these settlements, as the final payout is the end of that transaction. Speaking one-on-one with an agent, or in conjunction with a financial planner, can allow for a better understanding and greater time to calmly walk through the decision-making process without any pressure to lock down a viatical settlement. While the viatical will be greater than a policy’s cash surrender value, it is important for families to be in the know on the fiduciary duty that comes as viator. At the end of the day, a respectful agent will give families peace of mind when they need it most.

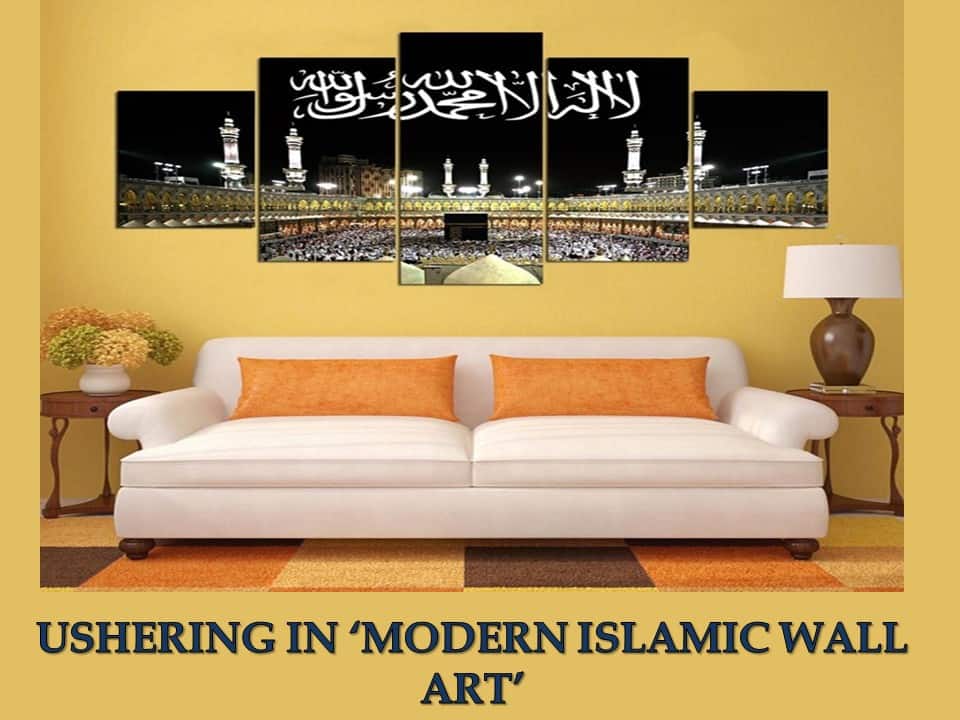

USHERING IN ‘MODERN ISLAMIC WALL ART’

USHERING IN ‘MODERN ISLAMIC WALL ART’ A definitive guide on how Oil market price affects the Industrial Pump Market

A definitive guide on how Oil market price affects the Industrial Pump Market Tips to Offer Improved e-Commerce Payment Gateways

Tips to Offer Improved e-Commerce Payment Gateways 3 Home Businesses You Can Start Today

3 Home Businesses You Can Start Today