Dove in and entering the crypto space can be overwhelming. There is no centralized authority to hold your hand, and the bits of gossip and stories circling around digital monetary forms can be fear-initiating.

Gratefully, the cryptographic money community is extremely useful and is in no deficiency of a word of wisdom.

With these couple of direct tips, arranging your first Bitcoin exchange or transaction can be significantly less distressing.

-

Table of Contents

Do some research on your own!

There is a lot of buildup, talk, examples of overcoming adversity and stories of ghastliness with regards to Bitcoin and other advanced monetary forms. Ensure you see precisely what you’re getting into, and don’t invest more cash than you could stand to lose.

Bitcoin is an energizing world to be in, yet it is one that is unpredictable and confounding in the event that you just enter it on hype. Numerous individuals purchase costly cars, not knowing how the motor works, and that is fine in light of the fact that on the off chance that it breaks there are mechanics and garages. In the digital money world, it is you against the world, it is decentralized and there is nobody to hold your hand.

Pawel Kuskowski, CEO and fellow founder of Coinfirm, gave this guidance:

“The more you comprehend, the happier you will be.”

Don’t just hypothesize about the enormous cash there is to be made, really go out there and figure out how Bitcoin and Blockchain function. Lucas Geiger, originator, and CEO of Wireline says:

“This may appear glaringly evident, yet I think the main thing is set aside time to comprehend the Blockchain. I say this unequivocally on the grounds that few individuals will do this. In the event that you don’t have a comprehension of how Blockchain stores secure information, (for example, coins), at that point, you are putting resources into what might as well be called tulip knobs.”

A decent place to begin is the start – with Satoshi Nakamoto’s white paper. Crypto finance supervisor Jacob Eliosoff composed:

“On the off chance that you have any technical bent at all, take 10 minutes to leaf through the first 2008 Satoshi white paper. It’s just eight pages, neat and a rousing work of genius!”

The colossal thing about the digital money ecosystem, however, is that there is a considerable amount of material and data out there. Heaps of sites and assets are going for attempting to make the innovation simpler to get it.

Much more than that, the investment world is likewise trying to improve things by making Bitcoin more accessible to customary speculators.

-

Have your Brains enacted:

In any venture, there will be a risk, yet that risk is to some degree amplified by Bitcoin’s extraordinary volatility. Eliosoff stressed:

“This is yet a great degree high-hazard space. Try not to contribute cash you can’t stand to lose!”

It is enticing to be bold and audacious, tossing cash at Bitcoin in the wake of hearing the examples of success stories, yet particularly as a newbie, caution is the better piece of valor.

Marshall Swatt, a serial business visionary, proposed:

“Begin little and contribute a little bit of your capital.”

Moreover, from Tim Enneking, overseeing chief of Crypto Asset Management, prompts:

“Try not to pursue Bitcoin costs. Settle on an entry point and stay with it. With Bitcoin, you’re quite often right as far as predictable value – it’s your planning that may be off. In this way, be patient, and let the Bitcoin value come to you.”

There are various contributing methodologies that work extremely well with Bitcoin, and those that offer the most achievement are frequently the most mindful.

Things like ‘Dollar Cost Averaging’ – putting in a similar measure of cash into a speculation in the meantime every week or month – is great for Bitcoin as it causes you ride out the lows, and also the highs.

-

Diversify investments:

Most new digital money devotees hear first about Bitcoin, yet there are many different digital forms of money out there, and some have developed considerably quicker than even Bitcoin. Broadening is wise, especially since huge numbers of these “altcoins” perform well when Bitcoin drops. Tech business person Oliver Isaacs composes:

“Support against unpredictability and don’t put all of your investments tied up in one place. Much like putting resources into the share trading system or FX, you ought to differentiate your assets as a risk management procedure.”

Renowned worldwide stock picker Ronnie Moas is a solid devotee of expansion. It is anything but difficult to wind up rich just by one digital money, particularly Bitcoin, however it is critical to fence your wagers.

“Try not to put all your Crypto cash into Bitcoin,” Moas cautions. “You should broaden over no less than twelve of the coins from the excess of 1,000 names. Focus on names in the best 50.”

-

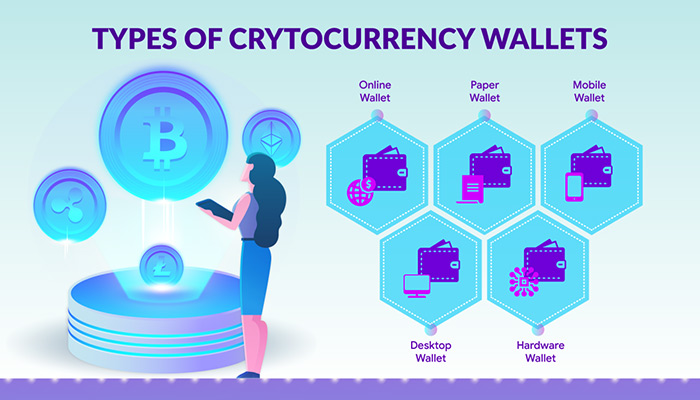

Protect your Coins:

There is still a great deal of hacking and robbery that goes ahead in the crypto space, and it is essential to avoid potential risk. It isn’t too difficult to make programmers’ lives troublesome. Utilize the trades for simply trading. When you have purchased a coin, move the coin of the trade and into a wallet that only you control, for example, an equipment wallet.

Many individuals have been burned on trade hacks – none more so than the real Mt. Gox one – however even as of late, things like BTC-e and the charges against their CEO would have made numerous individuals miss out on a gigantic amount of cash.

Matthew Unger, author, and CEO of iComply Investor Services Inc. recommended:

“Much the same as you keep some trade out your wallet, some in your financial balance and maybe the extremely profitable stuff in a protected, you have to oversee digital monetary forms similarly.”

-

Welcome to the roller-coaster ride:

Bitcoin is famous for its instability, to such an extent that numerous conventional investors are unnerved of it. A monstrous drop in Bitcoin’s cost does not spell perpetual fiasco, but rather it is difficult to remain submitted when you begin heading into the red.

Diversification is an extraordinary system to help with that, however, it requires some idea and exertion. Obviously, the most well known (thus far, effective) Bitcoin technique of all is to ‘hodl’ – or hold onto – your venture regardless of the market instability.

You can likewise purchase and overlook, as not watching out for the market can help shield you from stressing over the plunges and miss the instability.

Keeping Up With The Latest Trends in Cryptocurrencies!

Keeping Up With The Latest Trends in Cryptocurrencies! Pi Hut: A Haven for All Your Raspberry Pi Needs

Pi Hut: A Haven for All Your Raspberry Pi Needs Exploring Crypto Wallet Types

Exploring Crypto Wallet Types Pi to PKR Exchange rate: Converting Pi to PKR with Ease

Pi to PKR Exchange rate: Converting Pi to PKR with Ease